Simple Savings Account

Easy to access and simple to manage, our Savings Account could be right for you. Getting started is fast and easy. Checking your eligibility won’t impact your credit score. Save faster when you use our savings account with lots of opportunities to earn like "Cash Back Twice". Earn Cash Back TWICE. Earn cash back on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. All with no annual fee

Balance Transfer Fee: Intro fee of 3% of each transfer ($5 minimum) completed within the first 4 months of account opening. After that, 5% of each transfer ($5 minimum). Balance Transfers must be completed within 4 months of account opening. Balance Transfers do not earn cash back. Intro rate does not apply to purchases.

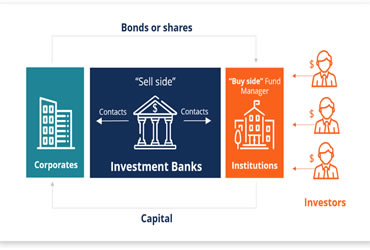

Investment Banking

Our investment banking sector handles; Underwriting – Capital raising and underwriting groups work between investors and companies that want to raise money or go public via the IPO process. This function serves the primary market or “new capital”.

Mergers & Acquisitions (M&A) – Advisory roles for both buyers and sellers of businesses, managing the M&A process start to finish. Sales & Trading – Matching up buyers and sellers of securities in the secondary market. Sales and trading groups in investment banking act as agents for clients and also can trade the firm’s own capital.Asset Management – Managing investments for a wide range of investors including institutions and individuals, across a wide range of investment styles.

Accounting Service

Explore our credit card offers, featuring exclusive perks and benefits to reward your spending. From cash back and travel cards, to low introductory APR on balance transfers, our has the right credit card for you. Browse our full range of credit card categories, or use our card comparison tool to discover features and help you choose the best credit card to fit your needs. Simply check the box next to your 3 favorite cards to compare the various benefits, rewards, fees and offers. When you're ready, select the credit card you’d like to learn more about and apply online.

Earn and redeem rewards with a card that adapts to fit your life. With the our Custom CashSM Card, earn extra cash back in the eligible category you spend the most in each billing cycle.

Loan Offers

For everything from consolidating debt to preparing for life's big moments, our can help you achieve your goals. Loan amounts from $2,000 to $30,000. Fixed rates of 7.99-23.99% APR. A lump sum payout of your loan. Once approved, a check will be mailed to you within 5 business days. You can repay your loan over 12, 24, 36, 48 or 60 months.

The benefits are: Predictable monthly payments, Setting up monthly payments with Auto Deduct at time of origination helps you to qualify for a lower rate and simplifies the repayment process, Simple application process, Quick access to your funds.